Fringe benefits – a guide for all

Background

The need for a fringe benefits tax (FBT) arose from the shortcomings of the definition of ordinary income.

Ordinary income is the concept that makes income that is not explicitly stated as taxable in the tax acts, as taxable. For example, wages are not expressly stated as taxable, however wages are taxable under the definition of ordinary income.

Broadly, the definition of ordinary income derives from common law and is held to exhibit the following characteristics:

is frequent and recurrent

relied upon by its recipient

ordinarily is a reward for personal exertion

is cash or its equivalent

Prior to the introduction of FBT, an employee could restructure their remuneration in such a way that it didn’t meet the definition of ordinary income. All that needed occur was that the thing the employee was receiving not meet one or more of the above criteria. For example, by not receiving cash, but something else such as property to substitute their wages, no tax would be levied on the property provided to the employee.

Due to this, the Fringe Benefits Tax Assessment Act 1986 (FBTAA) was introduced to levy tax on the employer for the provision of fringe benefits (ordinarily non-cash benefits) provided to employees for private consumption.

FBT problems continue to arise for both, for and not-for profit entities and can become complex. As a result, I have provided the below framework that one should adopt as a guide in how to deal with common FBT problems that arise in practice.

Another thing to bear in mind is that at first glance, FBT appears to be all encompassing. However, there are many exclusions, exemptions and reductions built into the act.

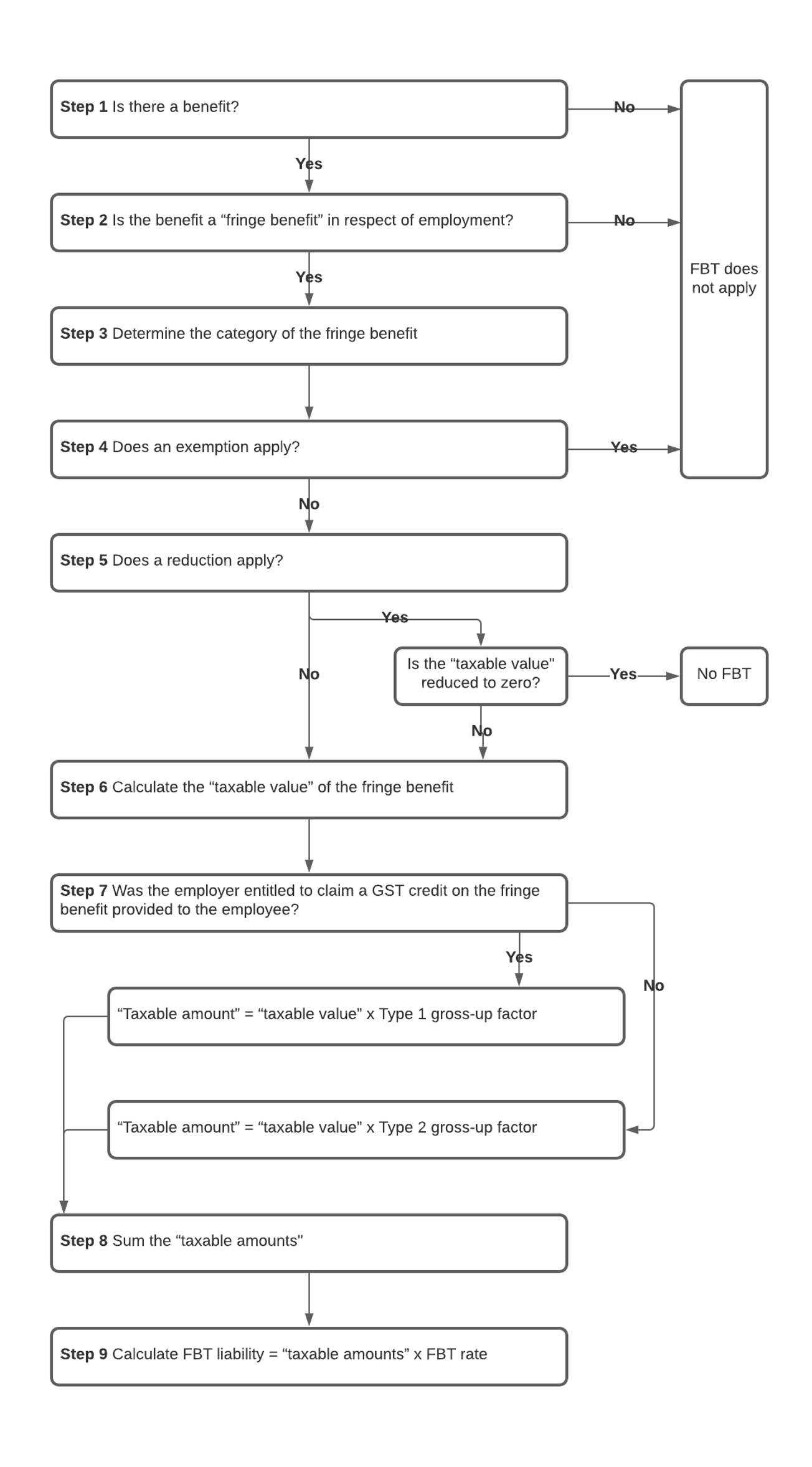

FBT decision tree

Step 1. Is there a benefit?

The definition of benefit is broad and includes any right… privilege, service or facility. Something as trivial as an employee’s use of the office kitchen to make a cup of coffee is a benefit.

Step 2. Is the benefit a fringe benefit in respect of employment?

A benefit is a fringe benefit if it is (s136(1) FBTAA):

provided to an employee (or an associate of the employee, such as a spouse)

by the employer, associate of the employer, or another person

under an agreement with the employer in respect of employment

and is not:

salary and wages, including employee allowances and exempt income

an exempt benefit

contributions to and payments from superannuation funds

benefits from employee share acquisition schemes

employment termination payments

capital payments for restraint made under a legally enforceable contract

capital payments for personal injury

deemed dividends

Who is an employee for FBT purposes?

An employee is someone who receives a salary or wages that attracts PAYG withholding. And encompasses past, present and future employees.

For example, a volunteer is not an employee, because they don’t receive a salary or wages that attracts PAYG withholding. By definition, any benefit provided to a volunteer is not a fringe benefit, because a volunteer is not an employee for FBT purposes.

Who is an employer for FBT purposes?

Broadly, an employer is an entity that pays salary and wages.

In respect of employment

Not every benefit is provided in respect of employment. There must be more than just a casual relationship between an employee’s employment and the benefit provided.

For example, repaying an employee for money they lent the employer is not the provision of a benefit in respect of employment. As the payment is made to settle the employee’s entitlement to receive funds because it is a creditor.

Exclusions

The definition of fringe benefit above contains a number of exclusions. These exclusions fall into two groups:

benefits outside the scope of FBT because these benefits are assessable under income tax rules. Examples include wages and salaries, superannuation contributions, etc.

exempt benefits contained within the FBT regime

There are both general and specific exemptions. Each category of fringe benefit may have a specific exemption to reduce FBT exposure (dealt with in Step 4). However, the most common general exemptions include:

minor benefit exemption

work related items exemption

taxi travel exemption

Minor benefit exemption exempts from FBT benefits that have a taxable value of less than $300 (GST inclusive) afforded they are infrequently and irregularly provided. This exemption does not apply to:

benefits provided under a salary sacrifice arrangement

inhouse fringe benefits

the meal entertainment fringe benefits category

An employer provides the employee with an inexpensive Christmas gift such as a bottle of wine costing $50. Assuming the employer does not frequently and regularly provide other minor benefits to this same employee throughout the FBT year, the gift is exempt from FBT because its taxable value is less than the $300 threshold.

Work related item exemption exempts from FBT work related items provided to an employee that are used primarily (more than 50% of the time) in the employee’s employment. Examples of work-related items include portable electronic devices, computer software, protective clothing, a briefcase and tools of trade.

An employer provides the employee with a laptop. The employee uses the laptop for work purposes 60% of the time. As the employee primarily uses the laptop for work related use, the provision of the laptop to the employee is exempt from FBT.

Taxi travel exemption exempts from FBT any taxi travel paid by the employer on behalf of the employee provided:

the taxi travel is a single trip beginning or ending at the employee’s place of work, or

result of sickness or injury to the employee and the travel is between the employee’s place of work, place of residence or other appropriate place (hospital, doctors, etc.)

An employee’s car breaks down whilst still at work. The employer arranges two taxi trips, one to drop the employee off at home for the evening and another to pick the employee up again the next morning to bring them to work. Because both single trips begin or end at the employee’s place of work, each trip is exempt from FBT.

Other miscellaneous exempt benefits are contained in Division 13. These are summarised in the table below:

Step 3. Determine the category of fringe benefit

There are a multitude of fringe benefit categories. I will explain the most common categories below.

-

Arises for an employee’s private use of an employer provided car, or when a car is available for private use.

Small Company Pty Ltd provides Amy (an employee) with a car to to use during work hours for work related travel. At the end of each day, Amy is required to securely park the car on Small Company’s premises and leave the keys on premises before departing home using their own car. No FBT applies as the car is not used for private purposes, nor is the car available for private use.

Medium Company Pty Ltd provides a car to Rose (an employee) to use. Rose is able to take the car back home. Despite Rose not using the car for private purposes, FBT applies because the car is available for private use.

-

Arises when an employer waives or releases an employee from an obligation to pay an amount to the employer.

ABC Trading Trust loans Joe (an employee) $10,000. Two years pass and ABC becomes aware that Joe is experiencing financial difficulty. As a goodwill gesture, ABC waives the debt and releases Joe from any obligation to make repayment. FBT applies on the amount waived.

-

Arises when the employer provides an employee with a loan and the interest charged on the loan is lower than the benchmark interest rate. Regard should be had to the interaction with the debt waiver fringe benefits category.

XYZ Pty Ltd loans James $10,000 on interest free terms to help James paydown his credit card debt. For the respective FBT year, the Commissioner of taxation has determined a benchmark interest rate of 5.20%. FBT will apply as the interest rate charged, being nil, is less than the benchmark rate.

Expanding on the above example, assume that at the end of the first year, XYZ waives the loan and releases James of any obligation to repay the money. There will be two fringe benefits here, the first being a loan fringe benefit (discussed above), the second being a debt waiver fringe benefit for the waiving of the debt.

-

Arises when an employee incurs expenses and the employer pays or reimburses the employee for those expenses and, some or all of the expenses paid for or reimbursed by the employer are private in nature.

Expense payment fringe benefits are further classified as:

inhouse

external

External expense payment fringe benefits are those acquired from third parties where the benefits themselves have not originated with the employer.

Aus Co Pty Ltd agrees to pay Raj’s (an employee) rent for the next few months. Irrespective of whether Aus Co pays the agreed sum to the agent or reimburses Raj directly, FBT will apply as there is an external expense payment fringe benefit.

Inhouse expense payment fringe benefits are those acquired from third parties where the employer was the original source of the benefit (expenditure paid or reimbursed is related to the purchase of goods or services that are normally purchased or produced by the employers for resale to customers).

Tel Co Pty Ltd, a popular mobile phone reseller provides employees with a 20% cash reimbursement on any phone purchases its employees make. FBT will apply because the reimbursement is an inhouse expense payment fringe benefit.

It is important to distinguish between:

a reimbursement of expenses incurred by the employee – this is a fringe benefit, and the tax liability is borne by the employer

an allowance paid by the employer to the employee – this is not a fringe benefit, and the tax liability is borne by the employee

A sense check to be used:

a reimbursement requires an employee to be compensated exactly for the expenses already incurred

an allowance is usually a set amount paid in advance and the amount is either prescribed by an industrial award or is a reasonable estimate of the employee’s expenditure

-

Arises when an employer provides an employee with car parking that is free or below market rates and:

there is a commercial parking station within one kilometre of the car parking facilities provided by the employer

the commercial parking station is available for all day parking and charges more than the car parking threshold

the car is parked in employer provided facilities at or near the employee’s primary place of employment for more than four hours

the car is either owned by the employee or is provided to the employee by the employer

the car is used on that day to commute between home and work

Hot Shot Lawyers Ltd is a well-established CBD legal firm. To ensure high billable hours and minimal disruption, HSL provides its management staff with free parking at its CBD offices. There are a multitude of commercial parking stations in the CBD and a Wilsons car park just across the road. Irrespective of who owns the car, FBT will apply because HSL is providing its management staff with car parking fringe benefits.

-

Arises when an employer provides property to an employee. This encompasses transfers of beneficial or legal interests in property. Property includes both tangible and intangible property.

Property fringe benefits are further classified as:

inhouse

external

An inhouse property fringe benefit consists of the provision of property that is identical or similar to property normally supplied by the employer to outsiders.

Craft Ltd is a craft beer importer that sources unique beers from abroad for resale in Australia. Every month, Craft allows its employees to take home a free case of craft beer. Craft will be liable for FBT because it is providing goods that it normally sells to its customers free of charge to its staff. The minor benefit exemption cannot apply because the free cases of beer are provided regularly and frequently.

All other property fringe benefits are external property fringe benefits.

Dodgy Accountants Pty Ltd is an accounting firm that employs Bob. Dodgy acquired a new photocopier that didn’t meet specification. Bob voiced that he needs a photocopier for his wife business. Dodgy agrees to gift the photocopier to Bob. Dodgy will be liable for FBT because the gifting of the photocopier to Bob gives rise to an external property fringe benefit.

-

A residual fringe benefit is a benefit not covered by any of the specific fringe benefit categories. Examples include free internet access, gas or electricity, or use of a vehicle that is not a car for FBT purposes.

Residual fringe benefits are further classified as:

inhouse

external

Step 4. Does an exemption apply?

In addition to the general exemptions detailed under exclusions at Step 2 above, each category of fringe benefit may contain specific exemptions.

-

Particular types of vehicles are exempt because they do not meet the definition of car. These include:

taxis, panel vans, utility trucks and other non-passenger road vehicles

motorcycles

unregistered cars used in business

vehicles designed to carry a loan of one tonne or more

vehicles designed to carry nine or more passengers

For example, an employer provides an employee with a ute to use during work. The employee is able to take the ute home. Whilst the vehicle is available for private use, a ute is not a motor vehicle of a kind for the purposes of the car fringe benefits category because it does not meet the definition of car. Provision of the ute may however be a residual benefit.

Another exemption relates to not double counting a vehicle’s running costs where a car fringe benefit has been provided. This is because the associated running costs are already considered in calculating the taxable value of a car fringe benefit.

For example, a fuel receipt is not treated as an expense payment fringe benefit, because its value is already included in determining the taxable value of the car fringe benefit.

-

No exemptions for this category.

-

An exemption exists if the employer is in the business of lending money and makes loans to employees on the same terms as loans it makes to the public.

Ethical Bank’s strategy is underpinned by the rapid capture of market share. As a result, it tends to charge a lower interest rate on borrowings compared to the ordinary bank. The average rate Ethical charges customers is 3%. Ethical also offers employees the same terms and interest rate should they wish to borrow from it. Despite the interest rate on any loan provided to an employee being lower than the benchmark rate set by the Commissioner, no FBT applies as Ethical is in the business of lending money and the terms of any loan made to employees is on the same terms made to customers.

Another exemption exists where the employer provides short term advances (up to six months) to help the employee cover employment related expenses. A further exemption also applies where an employer provides temporary advances (up to twelve months) to help cover a security deposit.

Where an employer who is a company, lends money to an employee who is also a shareholder of the employer, the loan is exempt from FBT.

-

Where an employee makes a no private use declaration, detailing that expenses reimbursed or borne by the employer where wholly for work related purposes, then the reimbursement is exempt from FBT.

Audit Limited is an auditing firm. Sometimes, its staff are required to incur parking fees when attending a client’s premises to carry out audit testing. Audit Limited reimburses its staff for any work-related parking fees incurred in attending and carrying duties at client premises. The staff sign no private use declarations, essentially declaring that the parking fees incurred are wholly for a work-related purpose. No FBT applies as the reimbursement is wholly for a work-related purpose and is not a reimbursement of private expenditure.

Where the employer reimburses the employee for car travel using the per kilometre car rates, the reimbursement is exempt from FBT.

-

The following are exempt from car parking fringe benefits:

religious, charitable or public education institutions and not for profit scientific institutions

employees of small business entities which turnover less than $10m where the employee’s car is not parked at a commercial parking station

employees who have a disabled persons parking permit

Small NFP is a small not for profit located in the CBD. As part of Small’s tenancy, it has access to five parking spots. Small has five staff, so this is great news as they have somewhere to park for free, which is somewhat compensatory for the lower salaries they are paid. If Small was unable to secure these car spaces, its employees would need to pay $30 per day in parking, as this is what the commercial parking station across the road charges. Small has an annual turnover of $1m. No FBT applies despite a commercial parking station existing within a 1km radius, this is because Small’s annual turnover is less than $10m and its employees’ vehicles are not parked at a commercial parking station.

-

Property benefits are exempt from FBT where they are consumed by employees, but not their associates, on working days at the employer’s premises.

Celebrate Limited held a Christmas party on the last day of work on its premises. Employees and their spouses were invited to celebrate. Food and alcohol were on offer. The provision of the food and alcohol by the employer for consumption by its employees is the provision of a property benefit. No FBT applies on the provision of food and alcohol to employees, however FBT will apply to the food and alcohol provided to spouses (i.e. associate).

-

Exemptions include those for:

employee transport provided by employers who are public transport providers

recreational or childcare facilities located on business premises

use of property, but not a car, that is usually located on business premises, in connection with the employer’s business (toilet, kitchenette, vending machine, etc.)

accommodation for eligible family members where an employee is living away from their usual place of residence for up to twelve months under a LAFHA arrangement

use of a motor vehicle that is not a car and there is no private use other than:

work related travel, including incidental travel required in the course of performing employment duties

other private use by the employee or their associate was minor, infrequent and irregular

Bob’s Building provides all its employees with utes, necessary to carry their tools to and from job sites. As a ute is not a vehicle of a kind that meets the definition of car, the provision of the ute for use by the employee cannot be a car fringe benefit. As a result, it is a residual fringe benefit. Employees private use of the ute is minor, infrequent, and irregular. This means that Bob’s Building is not subject to FBT as this residual fringe benefit is exempt.

Step 5. Does a reduction apply?

There are a few reduction mechanisms in the act to reduce the taxable value of fringe benefits. Some of the reductions are general and can be applied across numerous categories of fringe benefits. Others are specific to the type or category of fringe benefit.

The otherwise deductible rule

The otherwise deductible rule (ODR) may reduce the taxable value of some fringe benefits. The ODR reduces the taxable value of the benefit to the extent that the employee would have been entitled to a deduction had the expenditure on the benefit been incurred by the employee rather than the employer.

For example, an employer provides a loan fringe benefit to an employee. The employee uses the money to purchase a parcel of shares from which the employee hopes to derive dividend income. If the employee had borrowed the money from a bank, rather than receiving it from the employer, the employee would have been entitled to a deduction for interest on the loan because the borrowing has an income producing purpose. Under the ODR, the taxable value of the loan fringe benefit is reduced to the extent that the employee would have been entitled to a deduction (in this case 100%).

The ODR does not apply if the fringe benefit is an associate of the employee.

Using the same example from above, if the employee’s spouse (an associate) used the funds to acquire the shares. The ODR rule cannot operate to reduce the taxable value of the loan fringe benefit, because it only applies to the employee and not their associate. As a result, FBT would be payable by the employer.

The deduction to which the employee would otherwise have been entitled must be a once only deduction. This means that the ODR cannot be applied where a deduction that is spread over multiple years, such as the depreciation on an asset (unless the asset is fully depreciable in its first year) or for borrowing costs which are spread over the life of a loan.

For example, assuming an employer provides an employee with a desktop computer to take home and use to work from home. Had the employee acquired the computer themself, they would need to deduct it over numerous years. As this deduction is not a once only deduction, the ODR cannot apply to reduce the taxable value of the fringe benefit. Another exempting or reducing mechanism should be looked at, for example the work-related items exemption.

Recipient’s contribution

A contribution by an employee may reduce the taxable value of a fringe benefit.

There are generally two types of recipient contributions:

those made directly to the employer

those made to third parties

A contribution made by the employee to an employer will have GST repercussions where the employer is required to or is registered for GST.

For example, an employer provides a property fringe benefit to an employee with a taxable value of $10,000. The employee contributes $1,000 towards the cost of the benefit, thereby reducing the taxable value to $9,000. For GST purposes, the employee's $1,000 contribution is in return for the employer's taxable supply with a price of $1,000. A registered employer would need to remit 1/11th of $1,000 in GST in respect of the supply.

No GST repercussions arise for an employer where the contribution is made to a third party.

For example, a GST registered employer provides a car for an employee to use and take home after work. The employee pays $1,100 for fuel costs incurred to the various petrol stations. In addition to this, the employee makes after tax contributions of $2,200 to the employer. Total recipient contributions amount to $3,300 and will reduce the taxable value of fringe benefits by $3,300. However, the employer will now have a GST liability of $200. Being 1/11th of the contributions received from the employee.

$1,000 concession for inhouse benefits

A $1,000 reduction per employee can be applied to the total taxable value of inhouse fringe benefits. The reduction applies to all inhouse benefits, whether expense, property or residual fringe benefits.

The concession does not apply to benefits provided under a salary packaging arrangement.

ABC Accountants, offers to prepare the income tax returns of all its employees. The firm’s financial planning division also provides a free one-hour consultation valued at $700 to employees who wish to develop an initial investment strategy. The consultation does not form part of an employee’s salary package. Bill (an employee) takes up both offers.

Both benefits are services and give rise to residual fringe benefits.

Concerning the tax return preparation service… The otherwise deductible rule will apply to reduce the taxable value of this benefit to nil, as tax return preparation fees would have been otherwise deductible to Bill.

Concerning the initial investment strategy development service… The otherwise deductible rule is not available for this benefit because these costs are capital in nature. Bill would not have been eligible to claim a deduction had he personally incurred the $700. However, the $1,000 in-house benefit concession will apply and reduces the taxable value of the benefit to nil.

Step 6. Calculate the taxable value of fringe benefits

Taxable value is the notion of valuing the fringe benefit for tax purposes. That is, the measurement base used to value of the benefit in dollars that has been transferred to, or enjoyed by, the employee.

Generally, the valuation rules operating on either:

some arbitrary value

the amount of the employer’s cost

the market value of the benefit

The taxable value of a fringe benefit can be reduced by the above reduction mechanisms discussed above. That is, the taxable value of a fringe benefit is the value attributed to a fringe benefit (detailed below) less any relevant reductions.

Car fringe benefits

Two valuation methods:

statutory formula

operating cost method

The default valuation method is the statutory formula method, unless the operating cost method is elected.

Under the statutory formula method, the taxable value of a car fringe benefit is 20% of the car’s base value (broadly its GST inclusive price less stamp duty and registration). The formula is adjusted for the number of days the car was available for private use during the FBT year (1 April to 31 March). After four complete FBT years, that is, in the fifth FBT return year, a 1/3 reduction can be applied to the base value of the car, in effect lowering the taxable value of the fringe benefit.

For example, a car’s base value is $60,000. The car was acquired on 1 July and this was the day that it became available for private use. On 31 March of the following year, the car’s taxable value under the statutory formula method is $9,008 ($60,000 x 0.2 x 274/365). Further, assuming the employee had made a recipient contribution of $2,000, then the taxable value of $9,008 would be reduced to $7,008.

Assume that the above car has been held for four complete FBT years. In the fifth year, the car’s base value is reduced by 1/3, bringing it to $40,000. Assuming that it wasn’t sold and was available for private use for the whole year, the car’s taxable value would be $8,000 ($40,000 x 0.2 x 365/365). Had the employee made a recipient contribution of $2,000, then the taxable value of $8,000 would be reduced to $6,000.

Under the operating cost method, the taxable value of a car fringe benefit is the total of the following:

actual operating costs regardless of who paid for them (fuel, service and repairs, but not insured repairs)

registration and insurance

deemed interest and deemed depreciation, which is apportioned if the car is a fringe benefit for part of the year

multiplied by the private use percentage detailed in a 12-week logbook.

For example, an employer provided a car to an employee for an entire FBT year. The running costs were $6,000. Moreover, the employee had paid for $1,000 of running costs to third parties. Registration and insurance totalled $2,000. Deemed interest amounted to $2,500 and deemed depreciation $8,000. The business use percentage per the logbook was 80%, suggesting 20% private use. The taxable value before any recipient contribution is $3,900 (($6,000 + $1,000 + $2,000 + $2,500 + $8,000) x (1 – 80%)). The recipient contribution of $1,000 reduces the taxable value to $2,900.

Debt waiver fringe benefits

The taxable value of the debt waiver is the amount of payment or repayment waived.

XYZ Pty Ltd (XYZ) lends $5,000 to one of its employees, John. John encounters financial difficulties. In exchange for a partial repayment of $1,000, XYZ agrees to release John from any further obligations in relation to the debt. In this case, a debt waiver fringe benefit arises. The taxable value of that benefit is $4,000.

Loan fringe benefits

The taxable value of a loan fringe benefit is calculated as the difference between the:

interest that would have accrued during the FBT year if the statutory interest rate had applied to the outstanding daily balance of the loan, and

interest actually accrued

Assume ABC Accountants lends one of its employees $100,000 at an interest rate of 2% per annum on 1 July 2018. The employee uses that money for non-income-producing purposes. The loan fringe benefit has been provided for 274 days of the FBT year. Therefore, the taxable value of the loan fringe benefit would be calculated as $100,000 x (5.20% - 2.00%) x (274/365) = $2,402

Expense payment fringe benefits

The taxable value of an expense payment fringe benefit depends on whether it is an inhouse or external benefit.

The taxable value of an external expense payment fringe benefit is equal to the amount paid or reimbursed.

Aussie Furniture and Interior Design Pty Ltd (Aussie Furniture) reimburses its employees who incur taxi fares while travelling between stores for work-related purposes. Assuming no exemptions apply, the taxable value is equal to the amount reimbursed.

The taxable value of an inhouse property expense payment fringe benefit is the amount that would be the taxable value under the property fringe benefit rules for inhouse property fringe benefits. Broadly, depending on the facts this would be either:

the arm’s length selling price, or

the arm’s length purchase price paid by the employer, or

75% of the arm’s length price

Aussie Furniture manufactures furniture, which it sells through independent retailers. It reimburses its employees 20% of the amount they pay for Aussie Furniture products from retailers at the full retail price. The taxable value of the inhouse property expense payment fringe benefit would be equal to the lowest arm’s length selling price less the difference between the amount the employee paid and the amount they were reimbursed.

Refer to the section on property fringe benefits detailing the taxable value rules.

The taxable value of an inhouse residual expense payment fringe benefit is the amount that would be the taxable value under the residual fringe benefit rules for inhouse residual fringe benefits. This broadly equates to being 75% of the lowest price charged to the public for the same type of benefit.

Aussie Furniture also runs a franchise home decorating advice business. It reimburses its employees 20% of the amount they pay to engage the services of the franchisees. The taxable value of the inhouse residual fringe benefit would be equal to 75% of the lowest price Aussie Furniture would ordinarily charge the public, less the difference between the amount actually paid by the employee and the amount reimbursed.

Car parking fringe benefits

In working out the taxable value of car parking fringe benefits, an employer can elect to apply any of the following methods:

statutory formula method

12-week record keeping method

The statutory method is calculated by multiplying a daily rate by 228 and then adjusting for the number of days the car space was available during the FBT year.

The 12-week record keeping method tracks the number of times a car parking benefit is provided during the 12 weeks. The outcome is then multiplied by a daily rate. The output is then adjusted by a factor to annualise the outcome by multiplying it by 52/12 and then adjusting for the number of days car parking benefits were provided during the FBT year.

ABC Accountants has an office in Melbourne. ABC provides on-site parking to 20 employees. The nearest commercial parking station is 500 metres away, which charges the public a flat fee of $10 per day. A 12-week register is kept, and this reveals that 900 car parking benefits were provided during this time, the results of which can be used for the whole FBT year. Assuming that no FBT exemption applies, the taxable value of the car parking fringe benefits using the two methods would be calculated as follows:

statutory method - $45,600 (20 employees x $10 per day x 366/366 x 228)

12-week record keeping method - $39,000 (900 instances x $10 per day x 52/12 x 366/366)

The employer can elect for either method to apply to all employees, a specific class of employees or to specified employees.

The daily rate can be worked out by reference to:

commercial parking station method – determine the lowest fee charged by a commercial parking station operator within a one-kilometre radius

market value method – determine the arm’s length amount the employee could be expected to have paid

average cost method – determine the average of the lowest fees charged by any commercial parking station within a one-kilometre radius on the first and last days of the FBT year

Property fringe benefits

The taxable value of property fringe benefits depends on whether it is an inhouse or external benefit.

All property fringe benefits other than inhouse property fringe benefits are external property fringe benefits.

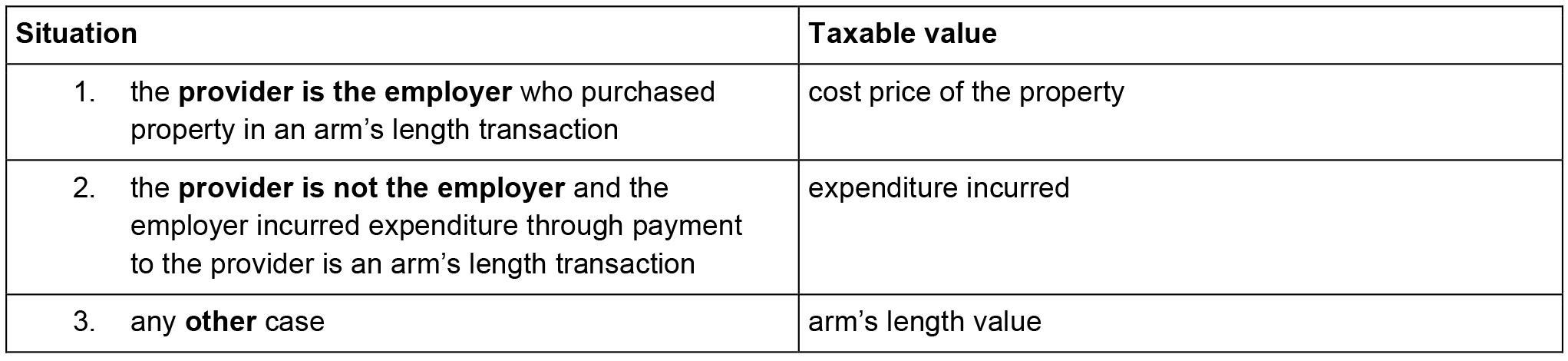

The taxable value of external property fringe benefits is summarised below:

An employee is provided with goods to the value of $500. The employee contribution of $250 is set without regard to how the employee intends to use the property. The taxable value of the property fringe benefit is $250 (that is, $500 reduced by the employee contribution of $250).

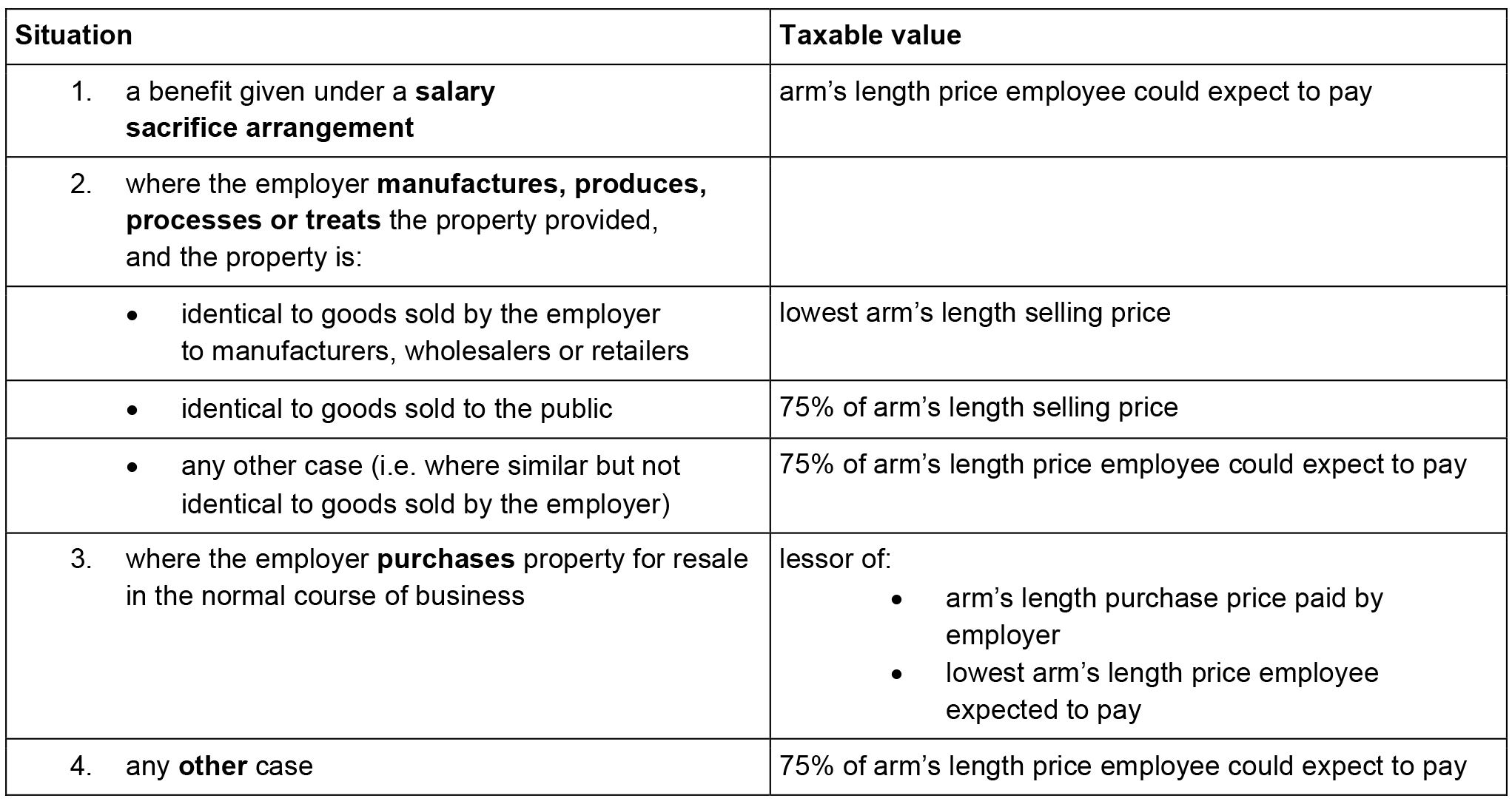

Inhouse property fringe benefits generally arise when the employer carries on a business that consists of, or includes, the provision of identical or similar goods to outsiders. Most common examples include staff discounts provided to employees working in retail, wholesale or manufacturing sectors.

The taxable value of inhouse property fringe benefits is summarised below:

Identical goods sold to manufacturers, wholesalers, or retailers

A manufacturer of electrical goods provides an item of stock to an employee (that is, an item identical to goods sold to wholesalers). The manufacturer usually sells the item for $1,000, including GST, to wholesalers. Each invoice provided allows for a discount of 5% for early payment, if the invoice is paid within seven days. If the wholesaler pays within seven days, they will pay $950 for the item. However, if the wholesaler does not pay within seven days, they will pay $1,000 for the item. The lowest arm's length selling price is $950.

Identical goods sold to the public

An employer manufactures desks for sale to the public and the lowest selling price of this type of desk to the public is $900, including GST. An employee purchases a desk for $500. The taxable value of the property fringe benefit is (75% × $900) - $500 = $175.

Similar but not identical goods

A sporting goods manufacturer makes squash racquets for sale by wholesale. Sometimes racquets are damaged in the manufacturing process. Instead of bringing the normal arm's length selling price (including GST) of $50, the damaged racquets have a market value of $30 each. An employee purchases a damaged racquet for $5. The taxable value of the property fringe benefit is (75% × $30) - $5 = $17.50.

Resale in normal course of business

A retailer purchases television receivers for $500 for sale to the public at a retail price of $750. The wholesaler paid GST on the sale to the retailer. An employee pays $400 for a receiver under the staff discount purchase scheme. The taxable value of the property fringe benefit is $500 - $400 = $100.

Residual fringe benefits

The taxable value of a residual fringe benefit depends on whether it is an inhouse or external benefit.

For external residual fringe benefits, the taxable value is generally the arm’s length cost of the benefit to the employer.

For inhouse residual fringe benefits given under a salary sacrifice arrangement, the taxable value is the arm’s length purchase price the employee expects to pay. Otherwise, the taxable value of an inhouse residual benefit is generally 75% of the lowest price charged to the public for the same type of benefit.

An employer who operates a television rental store allows an employee the use of a video recorder for three months during the FBT year. The normal arm's length cost of an equivalent rental granted to a member of the public at that time is $100. The employee is charged $50. The taxable value is (75% × $100) - $50 = $25.

Step 7. Was the employer entitled to claim a GST credit on the fringe benefit provided?

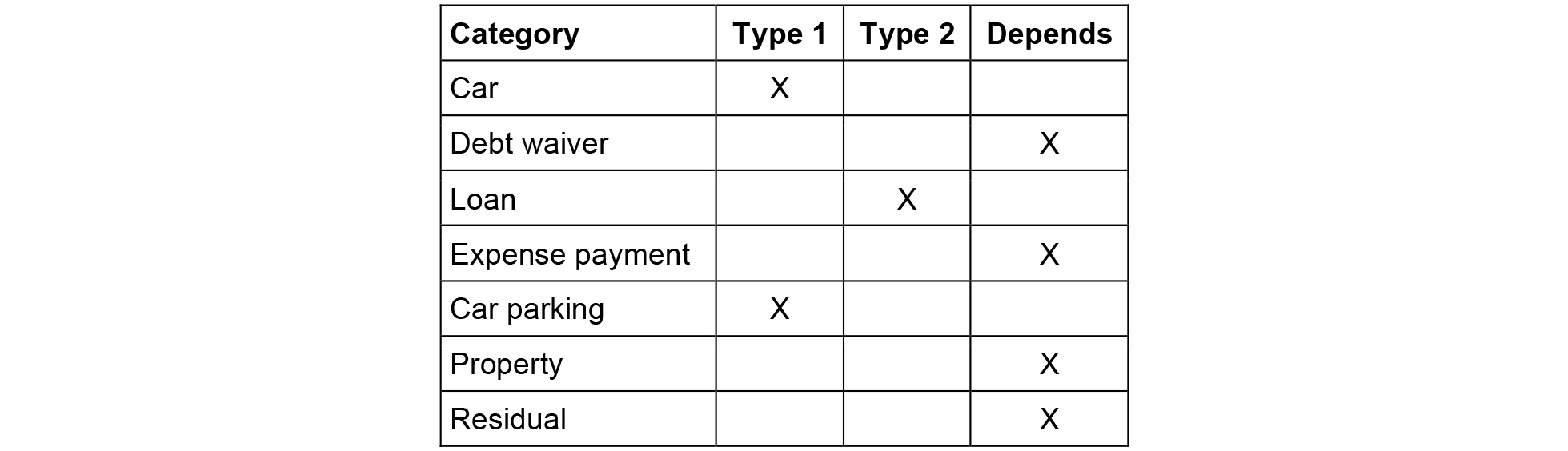

If a benefit provided is a creditable acquisition for GST purposes and the employer is GST registered, the benefit is a type 1 benefit, otherwise it is a type 2 benefit.

The entitlement to a GST input tax credit determines whether a fringe benefit is a:

type 1 benefit – employer entitled to a GST input tax credit for GST paid on benefits provided

type 2 benefit – employer not entitled to a GST input tax credit for GST paid on benefit provided

The reason for the difference in gross up rates reflects the fact that had the employee acquired the benefit personally, they would not have been entitled to a GST input tax credit. However, as the employer is entitled to such a credit, the step up in the type 1 rate seeks to make indifferent any salary packaging arbitrage (i.e. 10% discount on benefits) that an employee may or could have exploited by packaging GST creditable benefits.

The taxable value of a fringe benefit after any reductions is grossed up to determine its taxable amount. The taxable amount is the amount subject to FBT by multiplying it by the FBT tax rate. To determine the taxable amount of a fringe benefit, its taxable value is grossed up by:

2.0802 for type 1 benefits

1.8868 for type 2 benefits

In the 2018 FBT year an employer provides employees with fringe benefits with a taxable value of $50,000. After grossing up the $50,000 by the relevant gross-up factor (assume 1.8868 in this case), the employer has a fringe benefits taxable amount of $94,340. The employer is liable to pay FBT at the rate of 47% on the $94,340 (i.e. $44,340).

This means that all benefits can be type 2 benefits (where the employer is not GST registered). Where the employer is GST registered, some benefits will always be type 1 benefits, some benefits will always be type 2 benefits and some benefits could be either. For a GST registered employer, the following table summarises the usual type for each category:

However, a benefit that has been manufactured () cannot be a type 1 benefit. As a result, it will always be a type 2 benefit.

Archimedes Limited provides a bathtub it manufactured to Riccardo. The bathtub is identical to those normally sold to retailers and had an in-house property fringe benefit taxable value of $1,500. Archimedes Limited would treat the provision of the bathtub as a type 2 benefit.

Step 8. Sum the taxable amount

Steps 1 to 7 must be undertaken for each and every benefit provided. The taxable amount is the total aggregate of grossed up benefits to be subjected to FBT. It is the amount that FBT will be levied on.

In practice a worksheet model is normally adopted to limit errors. An example is provided below:

Step 9. Calculate FBT liability

An employer’s FBT liability is equal to the taxable amount of fringe benefits provided multiplied by the FBT rate. The FBT rate is ordinarily equal to the highest individual margin tax rate, so as to make indifferent the packaging of fringe benefits and receipt of an ordinary salary or wage. Using the above example, the FBT would be $15,643.01. Worked out by multiplying the taxable amount of $33,283 by the FBT rate of 47%.

Further, if an employer has made FBT instalments through its BAS lodgements, it is able to obtain credits when lodging its FBT return. Only instalments made during the FBT year are creditable (from 1 April to 31 March). Using the above example, assume that it is for the FBT year ended 31 March 2020 and that in each of the respective BASs, the employer made FBT instalments of $3,000.

Other considerations

-

Where the total taxable value of certain fringe benefits provided to an employee exceeds $2,000 in the FBT year (i.e. year ended 31 March), employers must record the grossed up value of those benefits on the employee’s PAYG payment summary for the corresponding income year (i.e. year ended 30 June) as reportable fringe benefit amounts.

Main benefits excluded from the reporting requirements are:

car parking fringe benefits (excluding car parking expense payment fringe benefits)

meal entertainment fringe benefits

exempt fringe benefits

otherwise deductible fringe benefits

The gross up factor used for reportable fringe benefit purposes is the type 2 irrespective of the actual type of benefit and the actual gross up rate that was used by the employer to complete their FBT return.

An employee does not pay income tax on the reportable amount of their fringe benefits. However, it is included in a number of income tests relating to government benefits and obligations, such as:

medicare levy surcharge

deduction for personal superannuation contributions

superannuation co-contributions

HELP repayments

child support obligations

entitlement to certain income tested benefits

-

FBT is assessed each year when employer’s annual FBT returns for the FBT year are lodged. The FBT year commences 1 April and ends 31 March of the subsequent calendar year.

FBT is a self-assessment tax, for which employers are liable to lodge an annual FBT return and pay any tax liability by 21 May.

Where an employer’s first FBT return shows a tax liability of $3,000 or more, the ATO will notify the employer to make quarterly FBT instalments for the next FBT year. These instalments are paid using the business activity statement (BAS). Any instalments made are credited towards the employer’s final FBT liability.

-

A payment made by another party (i.e. an employee) to reimburse the FBT liability of the employer is assessable income in the hands of the employer. Further, it is not an employee contribution and does not reduce the taxable value of the fringe benefit.

Where the employer is an exempt tax entity such as a registered charity, no income tax consequences arise.

-

Salary packaging is where an employee and employer agree that the remuneration of the employee that would otherwise be all paid in cash will be paid as both cash and fringe benefits. That part of cash remuneration that is allocated to a fringe benefit is said to be sacrificed.

Most employers adopt the total remuneration cost method for calculating the total remuneration, where the total cost for an employee is the aggregate:

of their gross salary

the cost of providing fringe benefits (including any FBT payable on those fringe benefits)

Once the employer has calculated the value of total remuneration, the employee may be given a choice about how that remuneration will be provided between salary and fringe benefits.

The purpose of packaging is to maximise the employee’s take home pay. In practice, most employers don’t package unless, the benefits packaged are exempt, or the employee is in the highest marginal tax bracket (they become indifferent), otherwise, an employee’s take home pay is reduced. This means employees are ordinarily better off when:

an exempt benefit is packaged

or where the employer is able to obtain an FBT concession (i.e. FBT rebate or FBT exemption)

Regal Legal is a firm of solicitors. Rob is an employee of the firm. Rob’s agreed upon remuneration is $150,000. Rob resides near his employer’s premises and pays about $40,000 in rent annually. Rob does not work from home. Rob’s annual take home pay after income tax is $107,003. After paying his rent, Rob is only left with $67,003 per annum.

Rob is not a tax lawyer and believes that if his rent is salary sacrificed, he will save tax because his gross pay reduces. At face value, Rob appears justified and opts to salary sacrifice his rent, bringing his gross remuneration down to $110,000. Income tax on his new gross is $28,197, artificially giving Rob an after tax and after rent take home pay of $81,803. However, because the salary sacrifice of his rent constitutes an expense payment fringe benefit, it triggers FBT for Regal Legal. As a result, Regal Legal will need to pay $35,472 in FBT.

It is unlikely that Regal Legal will want to bear this cost. This is because Regal Legal’s total cost of employment cap for Rob is $150,000, for which they have already parted ways with ($110K salary + $40K in rent). Having to pay FBT of $35,472 would mean that Rob is costing Regal Legal $185,472 and not $150,000. In this instance, Regal Legal would either:

reduce Rob’s gross salary by $35,472 or

require Rob to make recipient contributions of $35,472.

Irrespective, the impact would be a reduction in Rob’s net take home pay.

If Regal Legal reduces Rob’s gross salary, Rob’s new net take home pay after income tax and rent would equate to $58,760. If Regal Legal requires Rob to make recipient contributions, Rob’s new net take home pay after income tax and rent would equate to $46,331.

Rob is better off not salary sacrificing his rent at all.

As a rule of thumb, the PAYG withholding saved by the employee should exceed the FBT payable by the employer on provision of the benefit. Where this is the case, the employee is ordinarily better off, and the employer is indifferent.

Using the above, PAYGW on $150,000 is $42,997. And on $110,000, it is $28,197. The difference in gross represents the out of pocket for the rent, hence Rob would be indifferent to this, as $40K would need to be paid irrespective of how his remuneration is structured. The difference in PAYGW between the two is $14,800. However, as the FBT incurred would equate to $35,472 and this exceeds $14,800 saving in PAYGW, Rob should not enter this arrangement as it is unlikely to enhance his net take home pay.

-

There are obvious tax benefits for both employers and employees by including exempt benefits in a salary package:

the benefit is exempt from FBT

the benefit is not reported on the employee’s payment summary

the employer is generally entitled to a tax deduction (not applicable for tax exempt entities)

the employer may be entitled to GST input tax credits where the thing acquired by the employer is a taxable supply for GST purposes

The most popular exempt benefits to package appear to be:

a laptop computer

mobile phones used primarily for work related purposes

a briefcase

a calculator or electronic diary

computer software for work related purposes

small business car parking

inhouse benefits up to $1,000

tools of trade

relocation expenses

salary sacrificed into superannuation

Anne is an auditor employed by Audit Co. Anne’s agreed upon remuneration is $52K per annum. During the year, Anne acquires a briefcase for $299 and a laptop for $2,000. Anne is able to claim an outright deduction for the briefcase, however she must depreciate the laptop over its useful life to the extent it is used for work (i.e. 60%). Assume Anne’s total income tax liability after accounting for all relevant deductions is $8,220. Circa, Anne’s annual take home pay after work related items and income tax is $41,481.

Had Anne salary packaged the above exempt benefits, her annual take home pay after work related items and income tax would be $42,001. Anne would be $520 better off annually if she were to salary package.

Audit Co would be indifferent from a cashflow because no FBT is payable on the provision of exempt benefits. Audit Co’s cash outflow is the same ($52,000 = $299 + $2,000 + $49,701).

Benefits other than exempt benefits to package include items that are GST effective where the otherwise deductible rule applies. In essence the employee obtains a discount on the outgoing for the portion of the GST included in the cost of the item.

Tom is a Chartered Accountant. Annual membership fees total $880 (including GST). The membership fees are deductible should Tom incur them. If Tom were to pay for the membership, his outgoing would be $880. However, if Tom’s employer pays for the membership, Tom would only need to sacrifice $800 of his pre-tax salary, as opposed to paying $880 from his post-tax salary (i.e. savings). This is despite the fact his employer will pay $880, because his employer will also be entitled to a GST credit of $80, resulting in a net cash outflow of $800. Because the otherwise deductible rule applies, the employer is not out of pocket for any FBT. As a result, Tom has obtained a discount on his annual membership fee.

The most common benefits packaged where the employer is exempt from FBT, subject to a cap, include:

a car

household bills

mortgage payments

rent payment

Mission Vision is a not for profit that is exempt from FBT. Rob is an employee with agreed upon remuneration of $150,000. Rob resides near his employer’s premises and pays about $40,000 in rent annually. Rob does not work from home. Rob’s annual take home pay after income tax is $107,003. After paying his rent, Rob is only left with $67,003 per annum.

Rob’s mate is a tax accountant and advises Rob that because his employer is exempt from FBT, there is scope for packaging opportunities. Rob and his employer agree to salary sacrifice $15,900 in rental payments from Rob’s annual salary. Rob’s gross salary is now $134,100. Income tax on his new gross is $37,114 and the remaining annual rent payable is $24,100. Rob’s net take home pay after income tax and rent is now $72,886. Compared to his net position before, Rob is $5,883 better off.

Mission Vision is not liable for FBT because despite the payment of rent constituting an expense payment fringe benefit, the taxable amount of the benefit, being $30,000 ($15,900 x 1.8868) is less than or equal to the $30,000 exemption cap.

Mission Vision is also indifferent from a cashflow perspective, mainly because no FBT is payable. Mission Vision’s total cost of employment cap for Rob is $150,000. Rob’s agreed upon package prior to packaging and subsequent packaging remains at $150,000 ($150,000 = $134,100 + $15,900).